In global real estate, scale separates ambition from achievement. In Dubai, scale determines survival.

Anthony Joseph understood that distinction early.

When he arrived in Dubai in 2014, he did not arrive as a decorated broker, a published author, or a developer overseeing multimillion-dollar projects. He arrived as a newcomer in one of the most competitive property markets in the world — without capital reserves, established networks, or institutional backing.

Today, with more than AED 9.2 billion in closed transactions — approximately $2.5 billion — his name is associated with disciplined execution in a city that measures credibility in quarterly results.

But numbers, impressive as they are, do not fully explain his trajectory. What defines Anthony Joseph is not velocity. It is engineering — the deliberate construction of systems that produce repeatable outcomes.

Redefining the Ceiling

Born in the United States and raised in Lebanon, Anthony Joseph grew up observing two contrasting economic realities. In Lebanon, resilience and resourcefulness are deeply embedded cultural traits. Yet, structural limitations often compress financial ambition.

A $500 monthly salary could represent stability. It could also represent stagnation.

He did not view that figure as an insult. He viewed it as a signal — evidence that environment shapes perception.

By 2014, he had reached a conclusion that would alter his career: if scale was limited locally, scale must be pursued elsewhere.

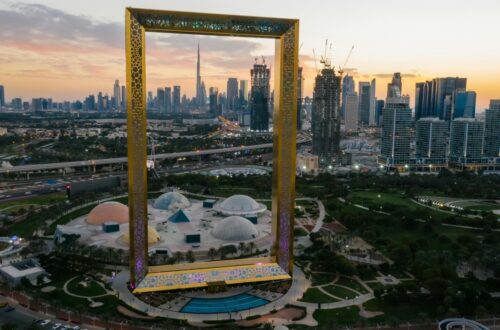

Dubai became the chosen ecosystem.

Entering a Performance Market

Dubai’s property market operates with institutional intensity. Developers move rapidly. Investors expect transparency. Brokers compete aggressively. Market cycles shift with global capital flows.

For newcomers, the environment is unforgiving.

Rather than pursue immediate commissions, Anthony Joseph invested his early years in market immersion. He studied developer financial models. He examined delivery timelines and payment structures. He analyzed how infrastructure expansions — metro lines, highways, master communities — translated into appreciation curves.

He learned buyer psychology across nationalities: European investors seeking rental yield, regional families prioritizing community amenities, global entrepreneurs diversifying portfolios.

He treated each transaction as data.

This patience delayed early income but built strategic depth.

From Transactions to Trust

By the time recognition began to follow, the foundation had already been laid.

Between 2018 and 2022, Anthony Joseph earned Best Broker of the Year recognition for multiple consecutive years — an uncommon feat in Dubai’s rotating hierarchy of top performers.

The distinction did not emerge from isolated landmark deals. It emerged from consistency.

Clients returned because projections aligned with outcomes. Developers trusted him with high-value portfolios because he represented projects with accuracy rather than exaggeration. In a market saturated with noise, clarity became differentiation.

Closing AED 9.2 billion in cumulative transactions was not a singular milestone. It was a compounding effect of process discipline.

The Expansion of Platform

As his brokerage career matured, Anthony Joseph resisted narrowing his identity to deal volume alone. He understood that credibility, once established, can extend beyond transactions.

He launched Dubai Stars, a podcast highlighting entrepreneurs shaping the region’s economic evolution. Rather than focusing on superficial success narratives, the conversations dissected operational strategies, capital allocation decisions, and resilience during downturns.

Shortly thereafter, he authored Take Charge, an Amazon bestseller centered on radical accountability. The book articulates a direct philosophy: waiting for ideal conditions delays growth. Ownership accelerates it.

These ventures were not diversions. They reinforced the same operational principle that defined his brokerage career — execution precedes expansion.

Transitioning from Broker to Builder

Perhaps the most significant pivot in Anthony Joseph’s career is not geographic but structural.

Through Lebanon Luxury Estate, he shifted from intermediary to developer.

As a broker, he facilitated alignment between buyers and projects. As a developer, he assumes responsibility across the full lifecycle: land acquisition, design supervision, construction oversight, and final delivery.

The portfolio includes luxury villas, mountain chalets, and a commercial tower — projects designed to introduce international-grade execution standards into Lebanon’s market.

The timing is unconventional. Lebanon faces economic volatility, currency instability, and infrastructure strain.

Yet volatility often reveals opportunity.

Anthony Joseph’s thesis is straightforward: in markets where expectations have declined, reliability becomes premium.

Deliver projects on time. Maintain structural quality. Ensure pricing transparency.

These principles, normalized in Dubai, become competitive advantages elsewhere.

Risk Recalibrated

Transitioning into development elevates exposure. Capital commitment increases. Operational complexity multiplies. Accountability becomes absolute.

But the shift aligns with his long-term framework: understand the system deeply enough to build within it.

Rather than exporting talent permanently, he is repatriating systems. Rather than retreating from challenge, he is applying discipline where it is least expected.

The strategy reframes return not as retreat, but as leverage.

Scaling the Framework

With over $2.5 billion in closed deals, Anthony Joseph’s expansion continues. Hospitality projects are under evaluation. Technology investments are being explored. Advisory roles for developers entering Middle Eastern markets are under consideration.

The through-line remains unchanged.

Decode the mechanics. Apply discipline. Scale responsibly.

Markets differ in regulation, infrastructure, and liquidity — but execution remains universal.

Geography as Variable, Not Verdict

Anthony Joseph’s rise across cities offers a strategic insight relevant to emerging-market entrepreneurs.

Geography defines context, not capacity.

He left Lebanon to expand exposure. He mastered Dubai’s performance culture. He returned with institutional standards embedded.

The buildings rising under Lebanon Luxury Estate will stand as physical assets. But the larger architecture is psychological — the refusal to internalize inherited ceilings.

In an era defined by volatility and migration, his model proposes something distinct: mobility as strategy, not escape.

Execution travels.

And when carried deliberately, it reshapes markets.